Finest Credit Union in Cheyenne Wyoming: Tailored Banking Providers for You

Wiki Article

Why Lending Institution Are the Secret to Financial Success

Credit scores unions have emerged as a compelling selection for those looking to boost their economic health. With an emphasis on tailored services and community-driven campaigns, credit score unions stand out as essential gamers in cultivating economic success.Advantages of Joining a Lending Institution

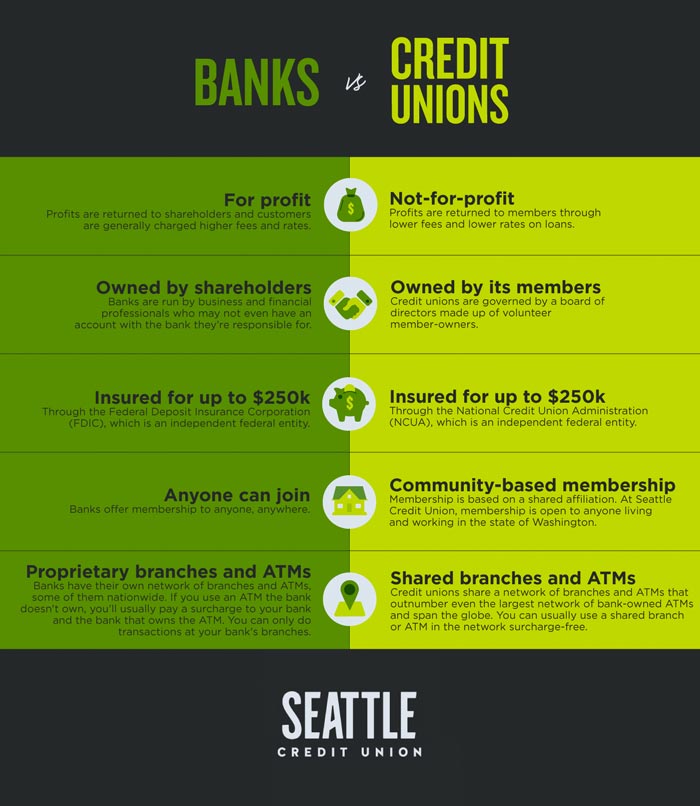

Signing up with a cooperative credit union offers various advantages that can favorably influence one's economic well-being. One substantial advantage is the sense of community that credit rating unions promote. Unlike standard financial institutions, cooperative credit union are member-owned cooperatives, which means that each member has a voice in how the union runs. This autonomous framework often results in an extra personalized banking experience, with a concentrate on fulfilling the demands of the members as opposed to maximizing revenues.Additionally, cooperative credit union frequently provide far better client service than bigger banks. Members often report greater fulfillment levels as a result of the individualized interest they receive. This commitment to participant service can lead to tailored economic remedies, such as tailored lending alternatives or financial education and learning programs, to aid members attain their financial goals.

Moreover, belonging of a lending institution can offer accessibility to a range of financial products and services, typically at even more competitive prices and with reduced fees than standard financial institutions. This can result in cost financial savings in time and add to total financial security.

Competitive Rates and Lower Fees

Cooperative credit union are known for using affordable prices and reduced fees compared to conventional banks, supplying participants with affordable financial remedies. One of the essential advantages of lending institution is their not-for-profit status, permitting them to focus on participant benefits over making the most of earnings. This distinction in framework usually converts right into much better rates of interest on interest-bearing accounts, lower rate of interest prices on loans, and lowered charges for different services.Personalized Financial Providers

With a concentrate on conference individual monetary requirements, credit score unions excel in supplying customized economic solutions customized to enhance member fulfillment and monetary success. Unlike traditional financial institutions, cooperative credit union focus on recognizing their members' distinct monetary scenarios to supply tailored remedies. This customized technique allows lending institution to supply a variety of services such as personalized monetary advice, customized car loan options, and individualized financial savings plans.Participants of credit unions can profit from personalized economic services in various methods. Furthermore, credit scores unions provide individualized monetary guidance to assist participants accomplish their financial objectives, whether it's saving for a significant acquisition, planning for retirement, or improving credit score ratings.

Area Support and Interaction

Stressing civic involvement and promoting interconnectedness, lending institution actively add to their areas via durable assistance initiatives and meaningful engagement programs. Neighborhood assistance goes to the core of lending institution' values, driving them to go past just financial services. These establishments commonly take part and organize in various local events, charity drives, and volunteer activities to provide back and reinforce the areas they offer.One means credit scores unions demonstrate their commitment to community support is by using financial education and literacy programs. By offering sources and workshops on budgeting, saving, and investing, they equip individuals to make educated economic choices, eventually adding to the general well-being of the community.

Additionally, credit unions regularly companion with local companies, institutions, and nonprofit companies to resolve specific neighborhood demands. Whether it's supporting tiny services with borrowing programs or sponsoring educational efforts, lending institution play an important duty in driving positive adjustment and fostering a feeling of belonging within their communities. With these collaborative efforts, lending institution not only boost financial success yet additionally cultivate a more resistant and inclusive society.

Building a Strong Financial Structure

Developing a solid financial foundation entails several vital elements. A spending plan serves as a roadmap for financial decision-making and assists organizations and people track their economic development.

Alongside budgeting, it is critical to develop an emergency situation fund to cover unforeseen expenditures or economic obstacles. Generally, economists recommend conserving 3 to 6 months' worth of living costs more info here in a quickly available account. This fund supplies a safeguard throughout difficult times and avoids people from entering into financial obligation to handle emergencies.

Moreover, managing debt plays a substantial role in strengthening financial foundations. Wyoming Credit Unions. It is vital to keep financial obligation levels convenient and work towards paying off high-interest financial obligations as swiftly as feasible. By decreasing debt, services and individuals can maximize more sources for spending and saving, eventually reinforcing their economic placement for the future

Verdict

In final thought, credit rating unions play a critical duty in advertising monetary success through their special advantages, including affordable rates, customized solutions, area assistance, and economic education and learning. By prioritizing participant complete satisfaction and proactively engaging with local areas, lending institution assist companies and people alike build a solid monetary structure for long-term prosperity and security. Signing up with a lending institution can be a tactical choice for those seeking to achieve monetary success.This dedication to member service can result in tailored financial options, such as personalized car loan options or monetary education and learning programs, to assist participants accomplish their financial goals.

A budget offers as a roadmap for monetary decision-making and aids businesses and individuals track their monetary progress.

In verdict, credit score unions play a vital role in promoting monetary success through their unique benefits, including affordable rates, individualized services, area assistance, and financial education.

Report this wiki page